First Capital Factors In Administration.Emergency Business Finance Due To Coronavirus.Cost Savings Of 31% On Invoice Finance Achieved.Help For A Business That Previously Failed.The 2021 BMF Awards Finalists Announced.3 New Invoice Finance Research Articles.35 Percent Invoice Finance Cost Savings.Specialist Help For Your Industry Sector.Non Recourse Export Invoice Discounting.Case Study London Based Web Advertising Company.

Case Study Prepayment Restrictions Due To HMRC Arrears.Case Study Factoring A Phoenix Of A CVA.Case Study One Off Cash Flow Fix For Marketing Agency.Case Study Funding Against Invoices To A Neutral Vendor.Case Study Factoring To Buy Out A Director.Case Study Factoring For Healthcare Recruitment.Case Study Dry Cleaning For Hotels And Bed And Breakfasts.

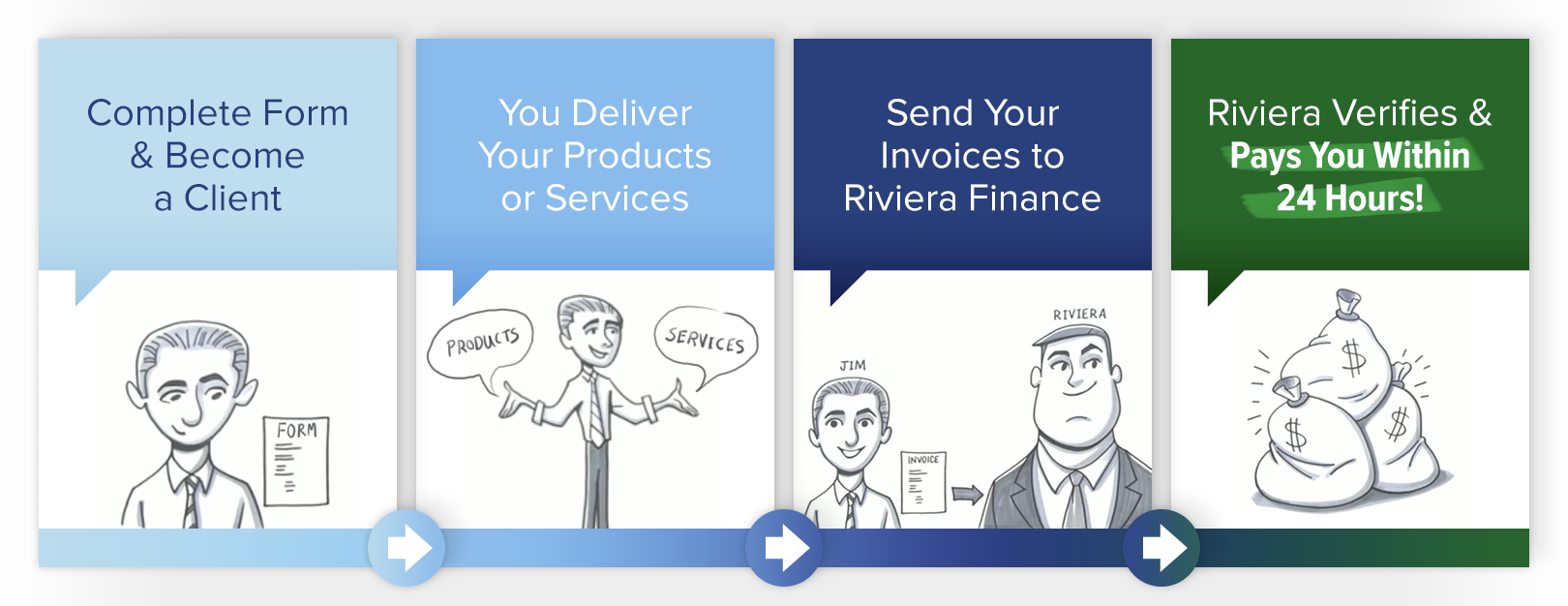

Case Study Small Business Confidential Factoring.Case Study CID For 15M Turnover Company.Case Study Too Small For Factoring Company.Case Study Confidential Invoice Discounting.Case Study Find Finance For A Permanent Recruitment Agency.Case Study Factoring For Care Home Staff Recruitment Agency.Case Study 42 Percent Cost Saving Via Magazine.Collect Invoices Confidentially And Funding.For more information on startup and business funding, or to complete a funding application, please visit our� website. This article was brought to you by� Intrepid Private Capital�Group�� A Global Financial Services Company. In comparison, it can take banks 60 to 90 days to approve a traditional small business loan. It often takes just two to three days for a factoring lender to approve a borrower’s loan application. Rather than waiting 60 days for a customer to pay, a business owner can use the invoice to secure a loan.įurthermore, approval times for factoring loans are typically shorter than traditional bank loans. This is assuming that the business has enough outstanding invoices to use as collateral.įactoring loans also allow business owners to turn invoices into cash more quickly than waiting for the customer to pay. Even if a business has bad or no credit, it may still be able to obtain a factoring loan. Since invoices are used as collateral, less weight is placed on the business’s credit history. First, they are easier to obtain than traditional unsecured loans from banks and other financial institutions. Benefits of Factoring Loansįactoring loans offer several benefits for business owners. For businesses that accept payment after the delivery of their product or service, however, a factoring loan is an attractive funding option. In this case, they typically won’t have receivables.

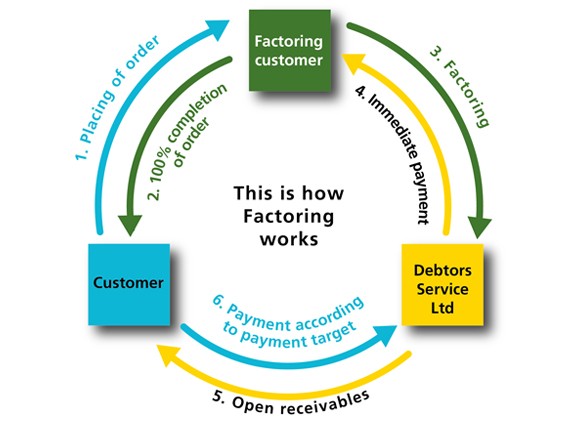

Granted, some businesses require payment at the time of delivery of their product or service. If he or she fails to pay back the loan according to the lender’s terms, however, the lender may take ownership of the invoices.Īccounts receivables - unpaid customer invoices - are a valuable asset for businesses. The business owner still retains legal ownership of the invoices. What is a Factoring Loan and How is it Used? Overview of Factoring LoansĪ factoring loan, also known as factoring receivables, is a type of funding method in which a business owner uses unpaid customer invoices as collateral under the agreement that he or she will pay back the loan. Let’s take a closer look at what is a factoring loan. If you’re thinking about using a factoring loan to fund your business’s operations, though, there are a few things you should know. This lowers the barrier of acquisition and offers a more attractive funding solution than traditional business loans issued by banks and other financial institutions. It allows businesses owners to secure capital using unpaid, outstanding invoices as collateral. Factoring loans have become a popular alternative funding solution for business owners.

0 kommentar(er)

0 kommentar(er)